UK gambling industry warns stricter affordability checks could backfire on economy

The UK's gambling industry supports 110,000 jobs and adds £7.1 billion to the economy each year. But new research suggests stricter affordability checks could shrink revenue and push players toward unregulated markets.

The Betting and Gaming Council (BGC) has warned that heavy-handed regulations may harm the sector's growth while failing to curb problem gambling.

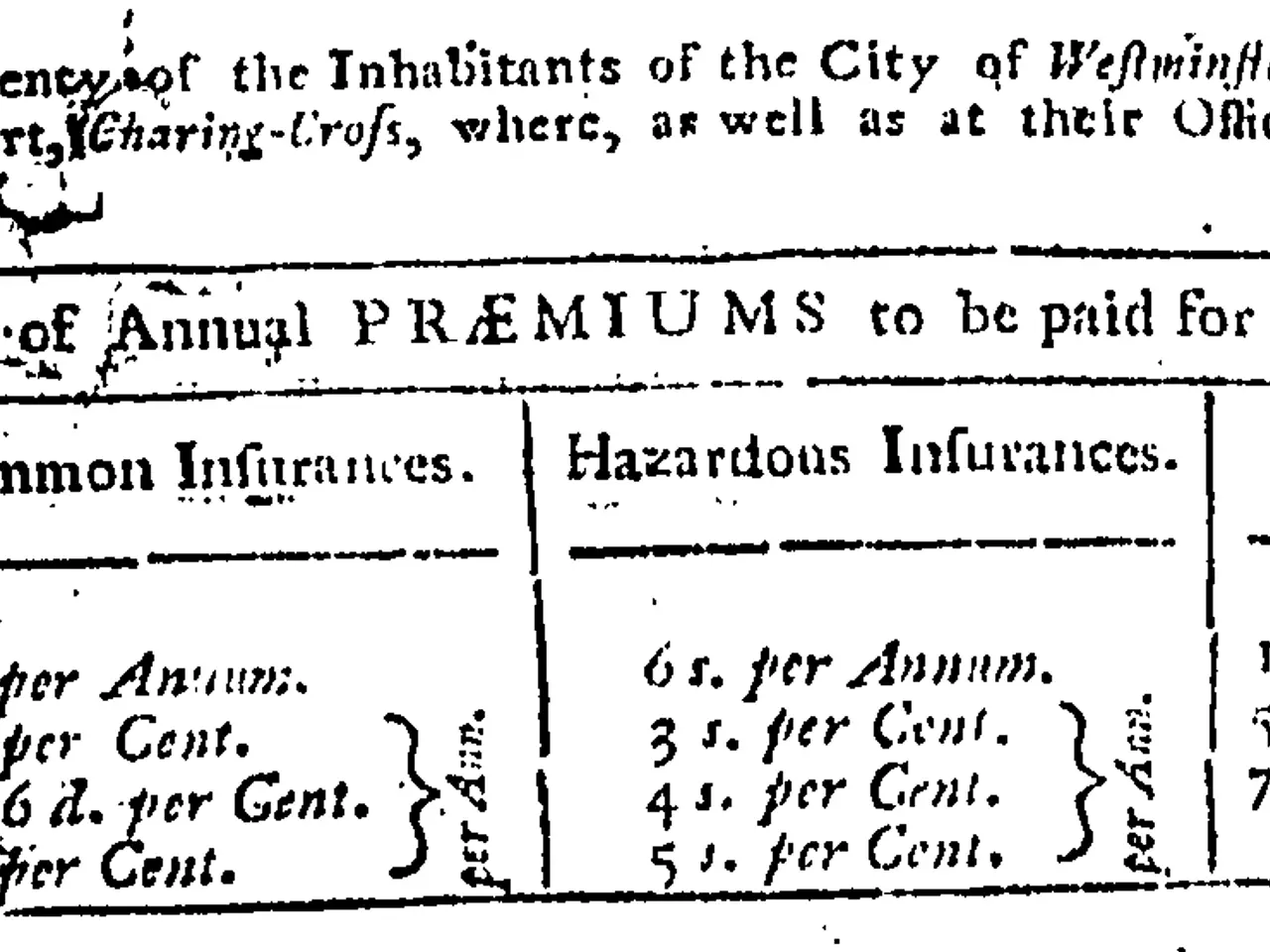

A report by EY highlights the risks of tighter betus and betmgm checks. The BGC argues these measures could reduce industry revenue and weaken its economic contributions. CEO Michael Dugher stressed the need for balanced rules that keep gamblers within legal, regulated sports betting markets.

The council also points to examples in Norway and France, where overly strict laws drove players to black market betonline operators. Dugher called for clearer guidelines on affordability checks, warning that excessive restrictions might shrink the regulated online betting sector.

Despite concerns, the BGC remains committed to responsible growth. Dugher noted the industry's willingness to invest in high streets, tourism, hospitality, and tech apprenticeships. The group insists sustainable regulations—rather than blanket restrictions—are the best way forward.

The BGC's stance comes as the government considers new gambling reforms. However, no official details on deposit limits or betus checks have been released in recent policy papers.

The gambling sector's future hinges on how regulations are shaped. If betus checks become too rigid, revenue and jobs could suffer, while illegal betting might rise. The BGC continues to push for policies that protect players without stifling a major economic contributor.