TMC Stock Soars 715% YTD Despite Deep-Sea Mining Risks

The Metals Company (TMC) has seen significant stock growth, up 715% year-to-date and 817% since its rally began a year ago. The company, which focuses on deep-sea mining, has had two press releases since summer, one detailing a combined net present value of $23.6B from its project plans and another confirming positive environmental studies. However, the outlook for TMC is bearish, with potential regulatory risks and net present value estimates that may not be fully accounted for by the stock market.

TMC's stock bottomed in August after announcing probable mineral reserves in 'deep-sea polymetallic nodules'. Its pre-feasibility study estimates revenue of $595 per tonne of dry material, with an EBITDA margin of $254. However, these estimates are subject to high capital costs and unproven technology at a commercial scale. The company's shift to seeking US permitting through NOAA carries additional regulatory risks, as the Clarion Clipper Zone is governed by the International Seabed Authority under the United Nations Convention of the Law of the Sea (UNCLOS), which the US has not ratified.

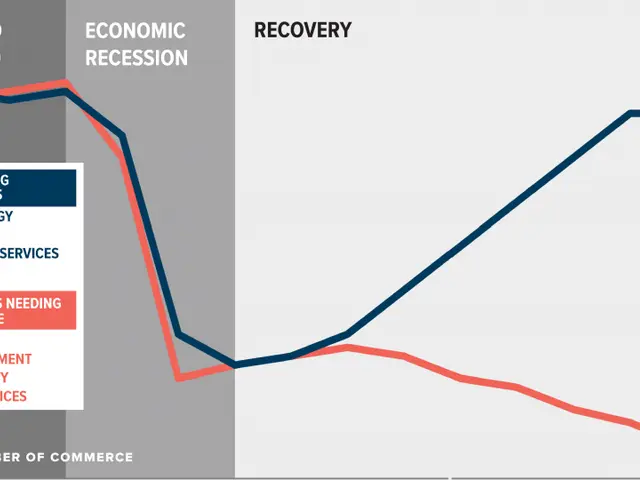

TMC's Q2 earnings report showed a -$0.20 EPS loss and a decline in cash to about $116M. Despite these challenges, TMC's stock has rallied, with the most recent surge tied to the 'Trump Admin battery and power technology trade', which supports smaller companies mining strategic or rare minerals or developing new technologies to utilize them. This rally has also been seen in several other companies in this theme, including Lithium Americas (LAC), United States Antimony (UAMY), and American Battery Technology (ABAT).

TMC's stock performance has been impressive, but the company faces significant challenges, including high capital costs, unproven technology, and regulatory risks. Its Q2 earnings report showed a loss and declining cash reserves. While the company has had some positive press releases and a recent rally tied to the 'Trump Admin battery and power technology trade', investors should be aware of the potential risks and uncertainties associated with TMC's deep-sea mining operations.