Intralot’s stock tumbles 17% after UK gambling tax hike shakes profits

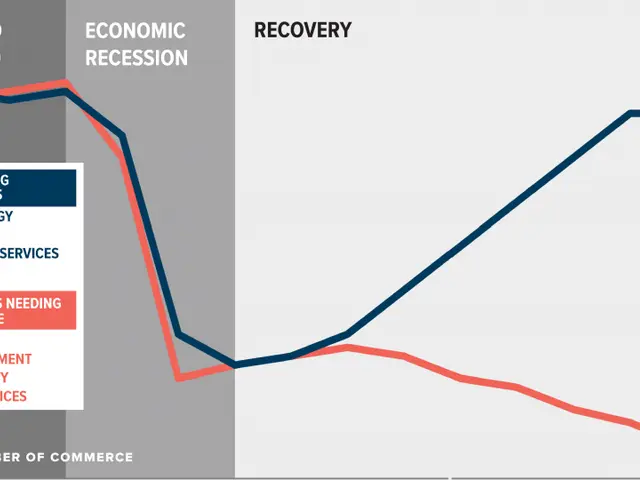

Intralot witnessed its stock market value fluctuate significantly this week following an adjustment to its financial projections. On Wednesday, shares plummeted by 17% in response to a downgraded profit forecast. However, a recovery ensued the following day as the company presented a plan to address escalating gambling taxes in the UK.

The predicament commenced when Intralot's management reduced its 2026 EBITDA estimate by 4%. The revision was a reaction to the UK's decision to double online gambling taxes. Investors promptly responded, driving the stock down 17% on the Athens Exchange by Wednesday's close.

The company now confronts a narrower profit margin due to the UK tax alterations. Nevertheless, the new strategy has already assuaged some investor apprehensions. Intralot's subsequent moves will dictate how effectively it accommodates the higher levies.