How Financial Speculation Turned Markets Into a High-Stakes Casino

Financial Casino: Gains for the Few, Crises for All

Above all, the AI bubble has reignited the debate about the damages that excessive speculation can cause or has caused. A philippic.

Published on 2025-12-06

Keywords: business, casino-and-gambling, casino-games, gambling-trends

Speculative trading in global markets has surged over the past few decades, reshaping economies and trade. While financial markets offer opportunities for growth, their volatility has also caused severe disruptions. From grain prices to currency crashes, the impact of unchecked speculation is now felt worldwide.

In the early 2000s, speculation in grain markets began to escalate. By 2002, wheat contracts worth eleven times the world’s actual wheat supply were being traded. This figure exploded to 73 times the real supply by 2011. Major players like hedge funds, Goldman Sachs, and JPMorgan Chase drove this surge, turning grain into a financial asset rather than just a commodity. The result was extreme price swings, making basic food staples unaffordable for many, especially in the Global South.

Wheat prices no longer reflect real supply and demand. Instead, they move based on trading patterns, detached from actual market conditions. This disconnect has pushed up costs for consumers and businesses alike, deepening inequality.

Currency markets have faced similar turmoil. In 1997, investor George Soros made massive profits by betting against the Thai baht. The attack destabilised Thailand’s economy, leading to a 10.5% contraction in 1998 and mass unemployment. The country, along with others, later stockpiled foreign reserves to guard against future speculative strikes.

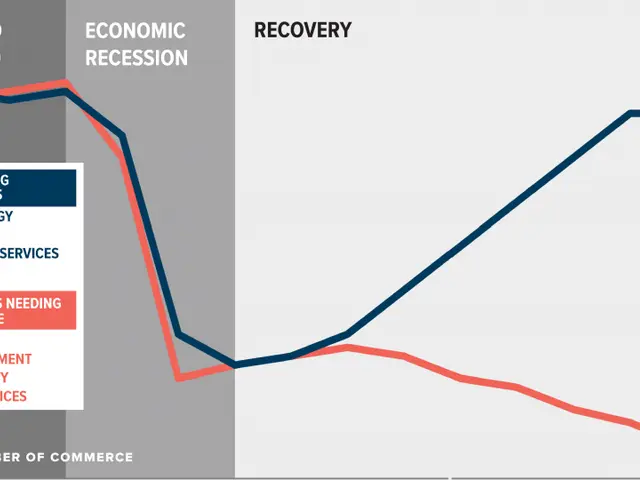

The scale of financial speculation has grown far beyond the real economy. In 1980, global financial assets equalled roughly the world’s GDP. Today, they are ten times larger. This expansion fuels instability, as speculators profit from volatility—something businesses and consumers cannot afford.

Even hedging, meant to protect against price spikes, has backfired. Instead of stabilising markets, it often increases speculation, pushing prices higher and creating more uncertainty.

The rise of speculative trading has reshaped global markets, from food to foreign exchange. Prices now fluctuate based on financial bets rather than real-world conditions, hitting vulnerable economies the hardest. Without stronger safeguards, the gap between market behaviour and economic reality is likely to widen further.

Read also:

- Ahmedabad University’s SICAFA Festival Bridges Tradition and Modern Art in a Week of Creativity

- Britain’s grand *Vision* spectacle blends military tradition with artistic brilliance

- Global entertainment industry to hit $3.5 trillion by 2029 as digital ads surge

- Free e-book lending slashes authors’ earnings in Germany, study finds