Ether’s 2024 crash exposes the risks of bold crypto price predictions

Ether ended 2024 trading at around $2,980, far below the ambitious price targets set by analysts and investors. The cryptocurrency’s performance fell short of predictions, including a high-profile bet between Kain Warwick and Multicoin Capital’s Kyle Samani.

In late 2023, Kain Warwick wagered $50,000 that Ether would hit $25,000 by the end of 2025. Kyle Samani, co-founder of Multicoin Capital, took the opposite side, doubting such a sharp recovery. The bet ended in Warwick’s loss, as Ether closed 2024 well below the target.

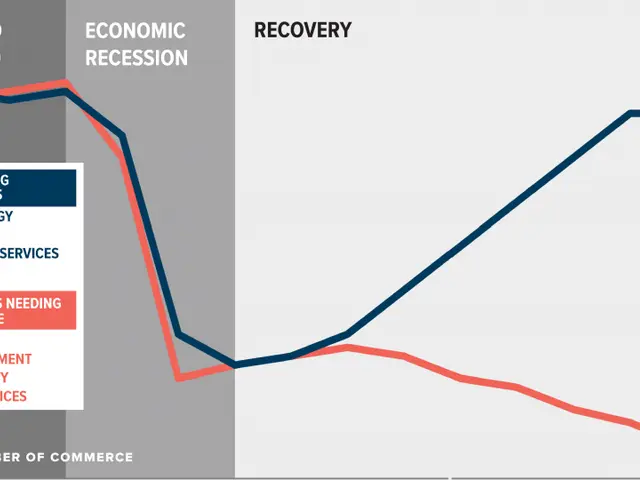

Other prominent figures also made bold forecasts. Arthur Hayes repeatedly predicted Ether would reach $10,000 in 2024, while Tom Lee projected a rise to $12,000. Neither materialised. Instead, Ether dropped 13.7% over the year, finishing at $2,980. A key moment came in October 2024, when a sudden mass liquidation of leveraged long positions triggered a market crash. Large traders and institutional investors, particularly on platforms like Binance, caused a flash crash that wiped over 10% off Ether’s value in hours. The event contributed to a broader $19 billion liquidation across the crypto market. Despite the setback, Warwick remains optimistic. He now expects Ether to reach $10,000 by 2026—a significant revision from his earlier $25,000 forecast.

Ether’s 2024 performance fell short of most bullish expectations, closing the year below $3,000. The failed predictions highlight the volatility of cryptocurrency markets, where sudden liquidations and shifting sentiment can drastically alter price trajectories.

Read also:

- Ghana’s second-hand clothing trade clashes with EU waste policies

- New book equips teachers to confront misinformation in heated classroom debates

- Black Friday aviation deals take off with model kits, flights and rare collectibles

- Going West: Enforcement Edge Is Live From San Francisco For The ABA White Collar Crime Conference